Umbrella Insurance

Extra Coverage for Financial Security

In today’s business environment, a standard General Liability Policy may not provide enough protection. Depending on the type of business you operate, you could face significant financial risks due to the rising number of lawsuits and unforeseen occurrences. That’s where commercial umbrella insurance comes in.

Small business umbrella insurance is designed to supplement your existing coverage by extending protection beyond the limits of your General Liability, Commercial Auto, or Employer’s Liability policies. If your primary policy limits are reached, umbrella insurance steps in, ensuring your business remains protected. Without this additional coverage, your business could be left vulnerable to financial strain.

How much commercial umbrella insurance is right for your business? Consider these factors:

- Type of Business: The nature of your operations impacts your risk exposure.

- Existing Coverage: Review your current General Liability and other policies to identify gaps.

- Assets to Protect: Businesses with significant assets should ensure adequate coverage.

- Uncovered Risks: Address risks that are not fully protected by primary policies.

Without proper umbrella coverage, business owners could face out-of-pocket expenses for lawsuits, medical costs, or damages not covered by existing policies.

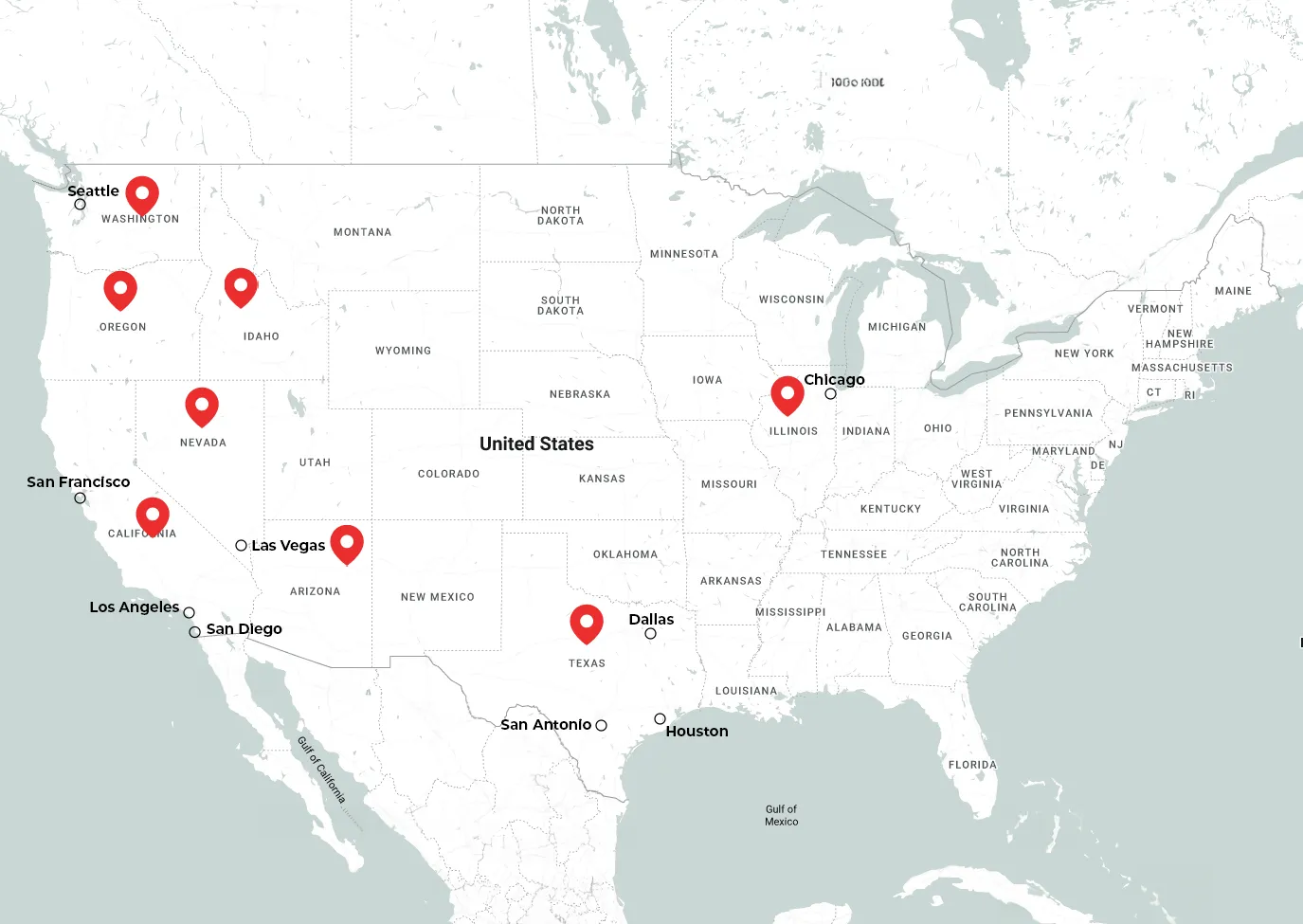

Don’t leave your business exposed to unnecessary risks. Contact us today to learn more about small business umbrella insurance and how it can protect your operations in California, Arizona, Nevada, Washington, Texas and Oregon. Our experienced team is here to help you find the right commercial umbrella insurance solution tailored to your needs.

Start a QuoteAreas We Serve

American Tri-Star provides auto coverage throughout California. Our car insurance agents in Orange County and San Diego County can help you understand your options. We also have representatives to assist your auto coverage needs in the Bay Area, Riverside County, and Los Angeles County.

Start a Quote