Commercial Auto

Tailored Protection for Business Vehicles

Commercial auto insurance provides essential coverage for your business vehicles, including physical damage and liability protection for scenarios not covered under a personal auto policy. This type of business liability insurance safeguards your operations by covering a wide range of vehicles, including cars, trucks, and fleets. At American Tri-Star Insurance Services Inc., we specialize in finding the best coverage tailored to your needs.

Navigating the various options for commercial auto insurance can be overwhelming. Our experienced agents can simplify the process by evaluating your specific requirements and recommending policies that address your business risks. This includes options that integrate contractual liability insurance, which offers additional protection for liabilities assumed under contracts, ensuring your business is fully covered in all situations.

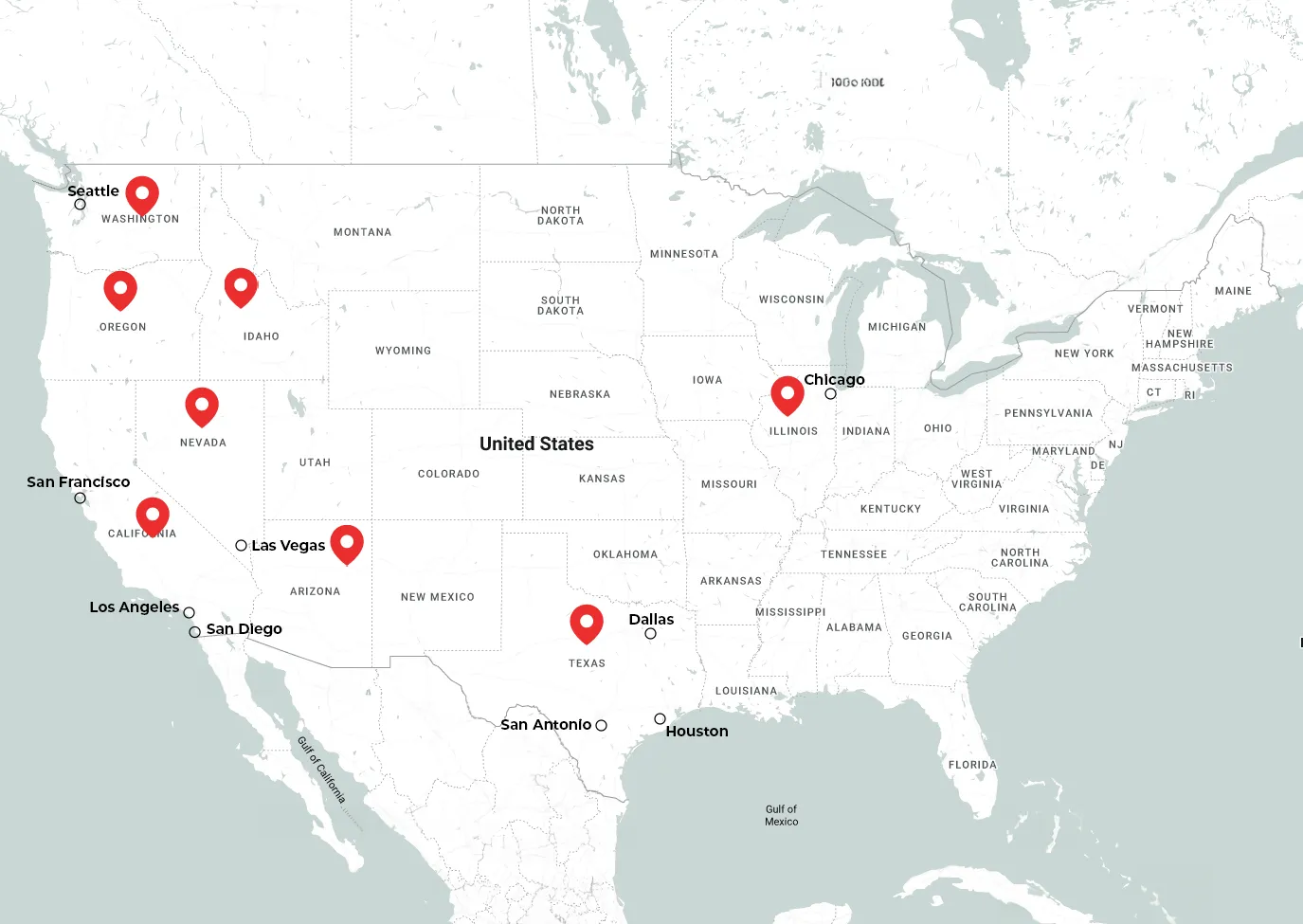

We provide customized commercial auto insurance solutions in San Diego and other areas throughout California, Arizona, Nevada, Washington, Texas and Oregon. Our policies are designed to protect your business vehicles, reduce risks, and provide peace of mind. Whether you’re a small business owner or managing a larger fleet, we ensure that your coverage meets your operational and legal requirements.

Let our knowledgeable agents handle your commercial auto insurance needs with a personalized approach. Contact us today to explore your options and ensure your business is protected on the road.

Start a QuoteAreas We Serve

American Tri-Star provides auto coverage throughout California. Our car insurance agents in Orange County and San Diego County can help you understand your options. We also have representatives to assist your auto coverage needs in the Bay Area, Riverside County, and Los Angeles County.

Start a Quote

FAQ

Why do you need commercial auto insurance?

In general, if a vehicle is used in tasks related to the operator’s occupation, profession, or business, other than commuting, a commercial policy is necessary. However, there are some other circumstances that require commercial auto insurance as well:

- If you are using your auto to transport goods or people for a fee or if you use your auto to conduct a service, you may need a commercial auto insurance policy.

- A commercial auto policy may be appropriate if you need higher limits of liability because of the nature of your work.

- Hauling a considerable weight in tools or equipment or towing a trailer used to conduct your business may require a commercial auto insurance policy.

- A commercial insurance policy may be needed if employees operate the auto or if ownership is in the name of a corporation or partnership.

What is the difference between commercial auto insurance and personal?

Commercial auto insurance, like your personal auto policy, provides similar coverages such as liability, collision, comprehensive, medical payments (or personal injury protection), and uninsured motorists coverage to businesses in California, Arizona, Nevada, and Oregon. In contrast, your commercial auto insurance and personal auto insurance policies may differ in their eligibility, definitions, coverages, exclusions, and limits. More specifically, unlike some personal policies, most commercial auto policies are “named driver only” policies, meaning only those drivers listed on the policy can operate the vehicle.

What does commercial auto insurance cover?

- Bodily injury liability coverage – pays for bodily injury or death resulting from an accident for which you are at fault; also provides legal defense.

- Property damage liability coverage – provides you with protection if your car accidentally damages another person’s property; also provides legal defense.

- Combined single limit (CSL) – Liability policies typically offer separate limits that apply to bodily injury claims for property damage. A combined single limits policy has the same dollar amount of coverage per covered occurrence whether bodily injury or property damage; one person or several.

- Medical payments, no-fault or Personal Injury Coverage – usually pays for the medical expenses of the driver and passengers in your car incurred as a result of a covered accident, regardless of fault.

- Uninsured motorist coverage – pays for your injuries and, in some circumstances, certain property damage caused by an uninsured or a hit-and-run driver. In some cases, underinsured motorist coverage is also included. This is for cases in which the at-fault driver has insufficient insurance.

- Comprehensive physical damage coverage – pays for damage to or replacement of your car from theft, vandalism, flood, fire, and other covered perils.

- Collision coverage – pays for damage to your car if it hits or is hit by another object.