Landlord Insurance

Tailored Protection for Landlords' Risks

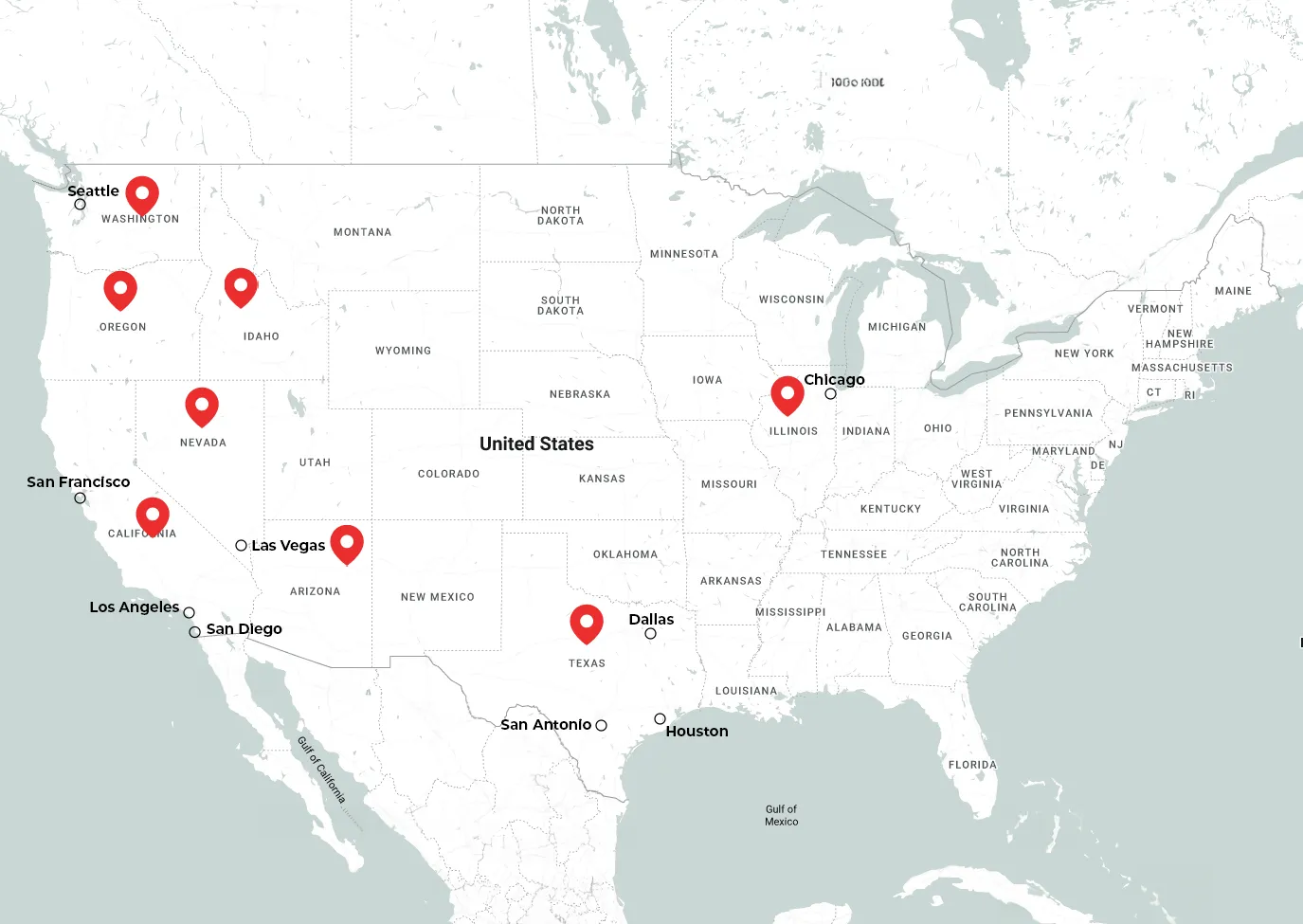

Dwelling or landlord insurance in California, Arizona, Nevada, Washington, Texas and Oregon covers property owners that rent out one or more of their properties, including homes, apartments, or condos. A landlord needs to have protection from any loss that may occur to their rental property, like fire or severe weather. You can also get insurance that will help cover the loss of income if your property can’t be rented due to a loss.

There are certain types of landlord rental coverages that you may choose to add to your policy, including:

Property

Covers your property if you have a loss due to fire, damage, or vandalism.

Income

Compensates you for any lost income that may occur from a covered loss. This coverage will reimburse lost income that you would have received if you had been collecting rent.

Liability

Protects you from liability losses like a claim or lawsuit. You want to be protected if there is an injured person on your property. Liability insurance will help cover these costs like medical payments, legal fees, or claims by the tenant.

Options

There are other options you may want to add with your insurance agent, such as rent guarantee, disaster, employer liability, or content insurance.

Landlord insurance can protect you from any financial loss that may occur to your rental property from accidents, injuries, or lawsuits. Since landlord insurance is very cost-effective, it is always a good idea to be protected in case of a loss.

Start a QuoteAreas We Serve

American Tri-Star provides auto coverage throughout California. Our car insurance agents in Orange County and San Diego County can help you understand your options. We also have representatives to assist your auto coverage needs in the Bay Area, Riverside County, and Los Angeles County.

Start a Quote