Auto Insurance Coverage

in California

Secure Your Drive

The car insurance companies we represent offer a broad range of benefits for every budget. And the cost of your premium could be even less if you qualify for discounts. When you apply for auto insurance, you’ll be asked a series of questions, including if you want collision, comprehensive coverage, or both.

We’ll ask about the liability limits you prefer and how much of a deductible you want. With the range of options available, deciding which is best for you can be confusing. That’s where we come in.

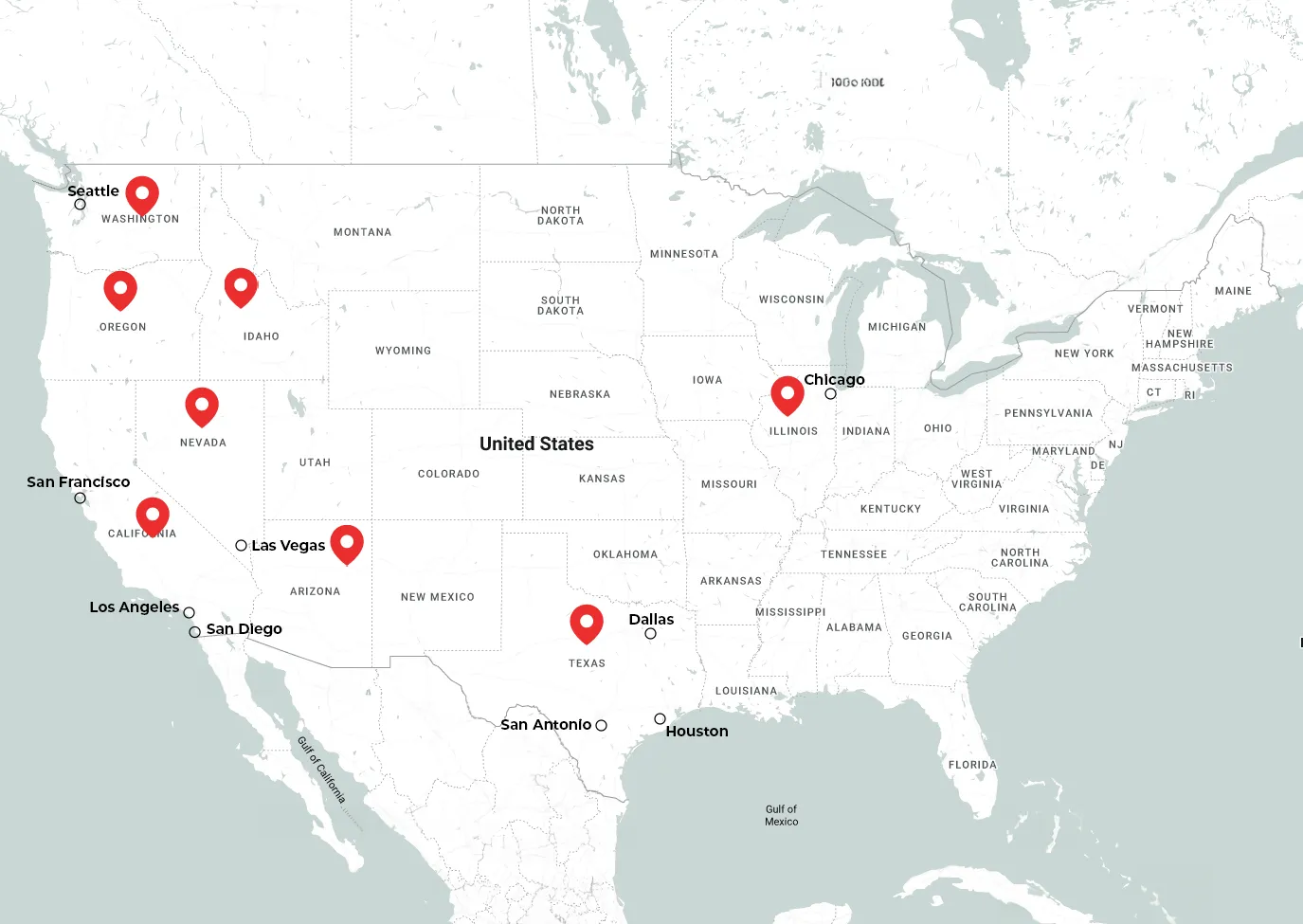

American Tri-Star Insurance has a team of experts ready to answer all your auto insurance questions. We can help you decide what level of coverage you need to make sure you choose the best policy to suit your needs. Find out why drivers turn to American Tri-Star for auto insurance in California, Arizona, Nevada, Washington, Texas and Oregon.

Start a QuoteAreas We Serve

American Tri-Star provides auto coverage throughout California. Our car insurance agents in Orange County and San Diego County can help you understand your options. We also have representatives to assist your auto coverage needs in the Bay Area, Riverside County, and Los Angeles County.

Start a Quote

What Are Collision and Comprehensive Coverages?

Collision and comprehensive coverages pay for damage to your vehicle following a crash. These types of coverage may be purchased individually or together as a bundle.

Collision coverage pays for any damage caused to your vehicle during an accident.

That can include harm caused by:

- another car

- a person

- an object

Comprehensive coverage insures you against any other physical damage to your vehicle.

That can include harm caused by:

- fire

- flood

- vandalism or theft

In the State of California, Collision and Comprehensive coverage are optional according to the DMV. But remember that auto lenders may require you to purchase a “full coverage’’ insurance policy before getting a new auto lease or a loan.

Your Options for Auto Insurance Coverage

There are several options for auto insurance coverage in California, and we’re here to help guide you through them. These specifics apply throughout the state, regardless of whether you need San Diego car insurance or Orange County car insurance.

Start a QuoteLiability Coverage

When you have bodily injury liability coverage, it pays for the cost of injuries to other people. Property damage liability covers the cost of damage caused to the personal property of others when the accident was your fault.

Personal Injury Protection

Also known as no-fault coverage, this policy pays for various expenses, including the cost of medical and rehabilitation services. It will also cover the cost of replacement services, funeral expenses, and loss of income if you are too injured from the accident to return to work.

Medical Payment Coverage

Medical payment coverage pays for medical expenses, up to a specified amount, for the policyholder and other passengers inside your car, regardless of who is at fault. However, if you and your passengers already have health insurance, you may not need to take out medical payment coverage.

Uninsured/Underinsured Motorist Coverage

This auto insurance coverage is beneficial if you are injured in an accident by an uninsured driver. It will extend your liability coverage to pay for your injuries even if you are at fault. It can also protect you if you are injured in a hit-and-run accident.

Optional Coverage for Auto Insurance

Our auto insurance policies in California offer additional coverage options like:

- Rental car reimbursement

- Roadside assistance

- Car towing coverage

These coverage options are not required, but they can save you lots of stress during your time of need.