Homeowners Association Insurance

Understanding HOA Insurance

Homeowners Association (HOA) insurance is a specialized policy designed to protect the common areas and shared assets of a community. Whether you manage a condominium complex, a planned community, or a gated neighborhood, this insurance plays a crucial role in safeguarding the property and ensuring the financial stability of your association.

Why HOA Insurance Is Essential

Protection of Common Areas

HOA insurance covers damages to shared spaces such as lobbies, swimming pools, clubhouses, and landscaping. This ensures that, in the event of a natural disaster, vandalism, or accidental damage, the repair or replacement of these areas is financially manageable.

Liability Coverage

In the case of injuries or accidents that occur on common property, liability coverage protects the HOA from costly lawsuits and medical claims. This is critical in mitigating risks associated with communal living.

Financial Stability

Having a robust insurance policy in place helps maintain the financial health of the association. It prevents the need for special assessments or sudden fee increases to cover unexpected expenses due to property damage or legal claims.

Lender Requirements

For many communities, securing adequate insurance is a requirement from lenders. It ensures that both the HOA and individual homeowners have protection against potential risks that could impact property values.

Key Components of an HOA Insurance Policy

- Common Areas: Covers repairs or rebuilding of shared facilities.

- Building Structures: In some cases, this includes coverage for building exteriors and interiors if the association owns certain structures.

- Third-Party Claims: Protects the HOA against claims from visitors or residents who may get injured on common property.

- Legal Costs: Covers legal fees in the event of lawsuits stemming from accidents or injuries.

- Management Protection: Provides coverage for board members if they are sued for alleged wrongful acts in their administrative roles.

- Policy Mismanagement: Protects against claims related to decisions made by the board that affect the association’s finances or operations.

- Fidelity Bonds: Protects the HOA from losses due to fraudulent activities by employees or board members.

- Environmental Liability: May cover clean-up costs and environmental damage resulting from specific hazards or disasters.

How to Choose the Right HOA Insurance Policy

- Risk Factors: Consider the geographical location, age of the property, and common risks (e.g., natural disasters, vandalism) when selecting coverage.

- Budget Considerations: Evaluate the balance between comprehensive coverage and affordable premiums.

- Insurance Agents and Brokers: Work with professionals who understand HOA insurance to ensure you receive tailored advice and the best possible policy options.

- Regular Reviews: Update the policy periodically as the community grows or as new risks emerge.

Conclusion

Areas We Serve

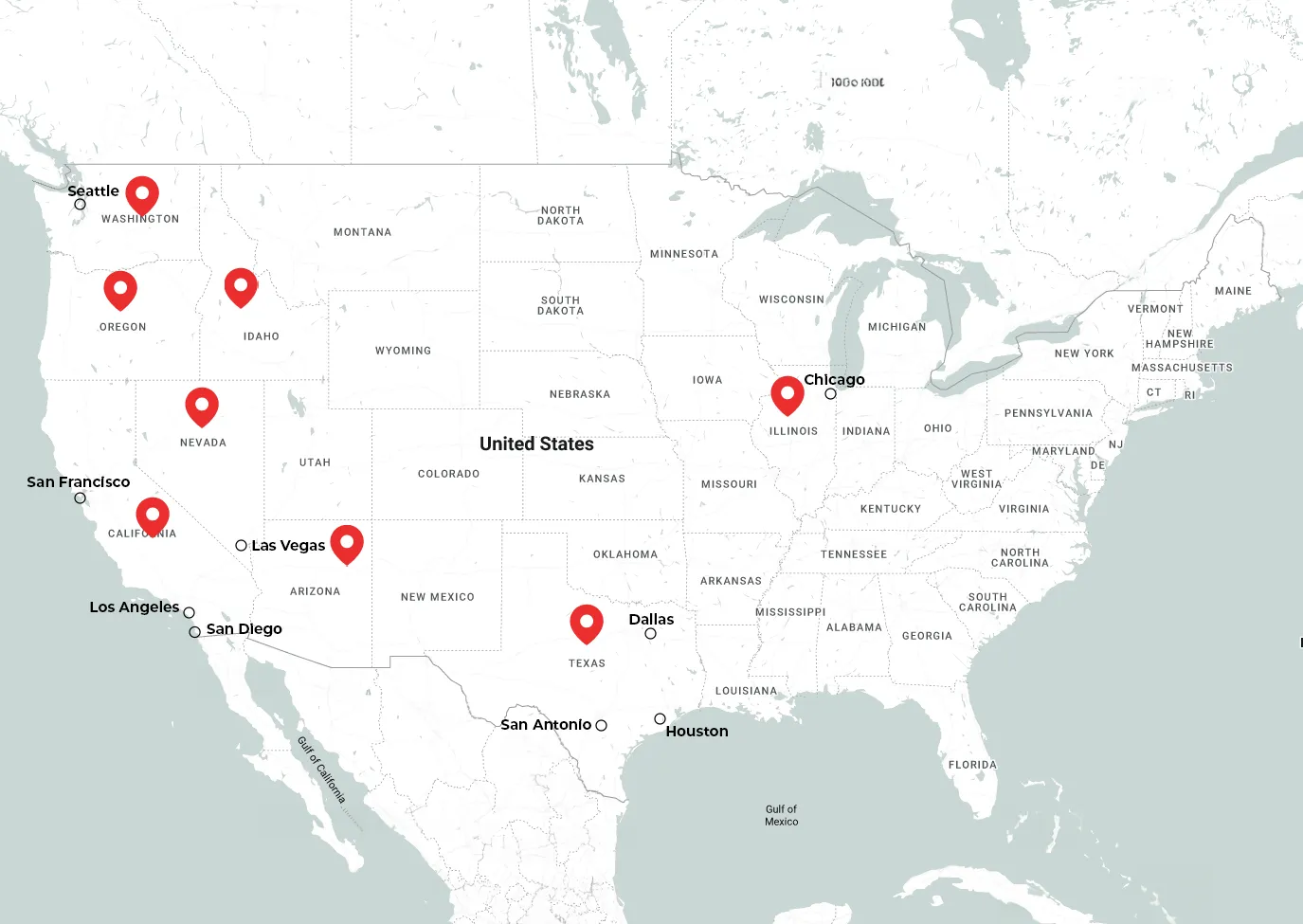

American Tri-Star provides auto coverage throughout California. Our car insurance agents in Orange County and San Diego County can help you understand your options. We also have representatives to assist your auto coverage needs in the Bay Area, Riverside County, and Los Angeles County.

Start a Quote

FAQ

Who is responsible for purchasing HOA insurance?

Typically, the HOA board is responsible for securing an insurance policy that covers common areas and liabilities. Individual homeowners should review their own policies to understand what is covered and what is not.

What isn’t covered by HOA insurance?

Most policies do not cover personal property or individual unit interiors. Homeowners should maintain their own insurance for personal belongings and interior modifications.

How does HOA insurance differ from homeowner’s insurance?

HOA insurance protects communal assets and areas, while homeowner’s insurance is tailored to cover an individual’s property and belongings within their unit.