Apartment Building Insurance

Tailored Insurance for Property Owners

At American Tri-Star Insurance Services Inc., we specialize in helping apartment building owners find the right insurance coverage to safeguard their investments. Our team evaluates your unique needs and offers customized insurance policies to ensure your property and operations are protected. With access to top-rated companies and risk management services, we can find competitive insurance programs for any type of building, including multi-family, student housing, senior housing, and furnished or mixed-use apartments.

Owning an apartment complex comes with unique risks, and having the right type of insurance is essential for protecting your investment. Our comprehensive solutions include insurance for apartment building owners to protect against damages and liability claims. Learn more about the average Apartment building insurance cost and what factors influence the cost to insure your property.

We also offer property owners liability insurance and general liability insurance that provide a vital layer of protection in case of bodily injury or property damage occurring on your premises. This type of liability policy is essential when dealing with frequent foot traffic, tenants, and third-party claims. Additionally, our umbrella insurance provides expanded coverage if damages exceed the limits of your standard policy.

How to Protect your Investment?

We understand that insuring commercial property such as residential buildings is different from homeowners insurance. Our packages are designed for small to large-scale buildings and can include:

- Property insurance

- Business contents

- General liability coverage

- Equipment Breakdown

- Broiler / Machinery

- Umbrella coverage

- Employee Dishonesty

- Workers Compensation

- Commercial Auto

- Commercial Umbrella

- Professional Liability

- Business Income

These components are part of a business owners policy (BOP), a package policy that consolidates essential protections. A BOP is ideal for apartment owners seeking streamlined solutions for liability and property damage, loss of income, and business liability risks. For a detailed breakdown of what these policies entail, visit our blog on apartment building insurance coverage.

Start a QuoteWhy Insurance Helps Protect You and Your Tenants

Having proper apartment insurance is not just about legal compliance—it’s about stability and trust. Whether you’re dealing with a prospective tenant, a long-term tenant, or managing multiple units, insurance helps protect both the physical building and your business operations.

Some tenants may carry renters insurance, but that won’t shield you from all risks as a landlord. Umbrella policies and umbrella insurance can extend your liability limits to safeguard against larger claims, especially those involving bodily injury, medical costs, or liability claims that arise in high-traffic areas.

Additional Coverage Options

Depending on your location and tenant demographics, we may recommend adding endorsement options such as:

- Flood and earthquake protection

- Vandalism coverage

- Loss of income due to a covered event

- Legal fees protection in case of liability claims

- Medical costs and lost wages following slips and falls

- Personal and advertising injury liability

Some clients may also benefit from mutual insurance arrangements or working with providers like Farmers Insurance, State Farm, or our own insurance group to find tailored options with appropriate deductible options and smooth renewal processes.

If you ever need to file a claim, our team is here to help streamline the process and protect your operational continuity. For full policy guidance, visit: apartment building insurance policy.

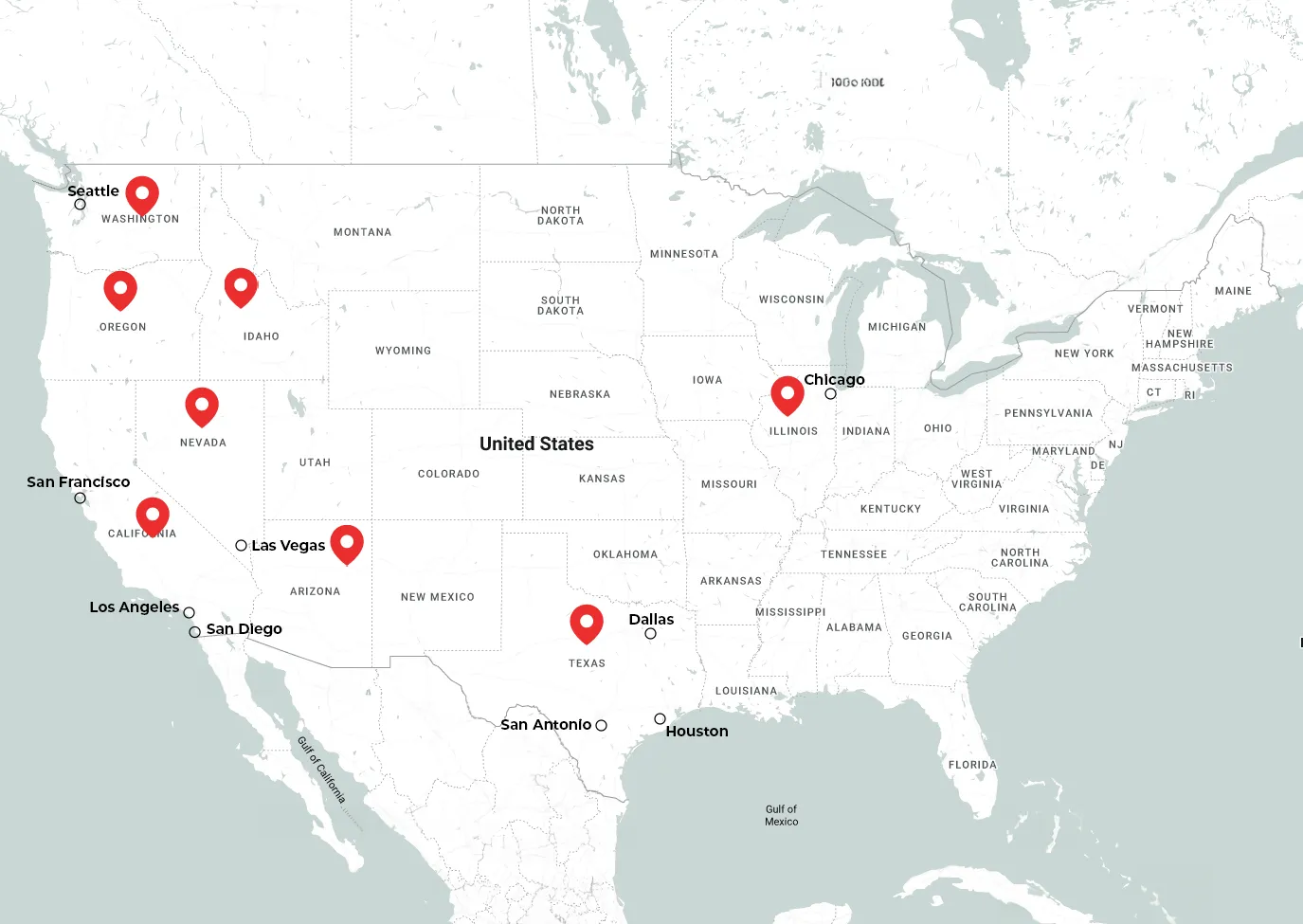

Areas We Serve

American Tri-Star provides auto coverage throughout California. Our car insurance agents in Orange County and San Diego County can help you understand your options. We also have representatives to assist your auto coverage needs in the Bay Area, Riverside County, and Los Angeles County.

Start a Quote

What does apartment building insurance cover?

Coverage includes property damage, liability, loss of income, and more. See our apartment building insurance coverage blog for details.

What kind of policy should apartment owners consider?

A business owners policy (BOP) combines property and liability coverage and can be expanded with umbrella insurance, earthquake coverage, and other add-ons.