Errors And Omissions Insurance

Essential Coverage for Professional Negligence

Errors and Omissions (E&O) insurance, also known as professional indemnity insurance, is a specialized form of liability coverage designed to safeguard your business from claims of professional negligence. These claims, whether valid or not, can result in lengthy legal battles and potentially devastating costs to your business.

Even lawsuits with no merit can harm your reputation and financial stability if you’re not adequately protected. At American Tri-Star Insurance Services Inc., we provide ongoing evaluations of your E&O and professional indemnity insurance needs to ensure you have the right policy at the best price for your specific business requirements.

Many professionals benefit from errors and omissions insurance, including:

- Consultants

- Financial Advisors

- Architects

- Real Estate Appraisers

- Brokers and Agents

- Attorneys

These industries face unique risks, and E&O coverage helps protect against costly lawsuits stemming from errors, omissions, or professional mistakes.

Without professional indemnity insurance, businesses may be forced to pay out-of-pocket for legal fees, settlements, and other damages. This can be especially damaging for small or growing businesses. Having the right coverage ensures peace of mind and financial security, allowing you to focus on serving your clients.

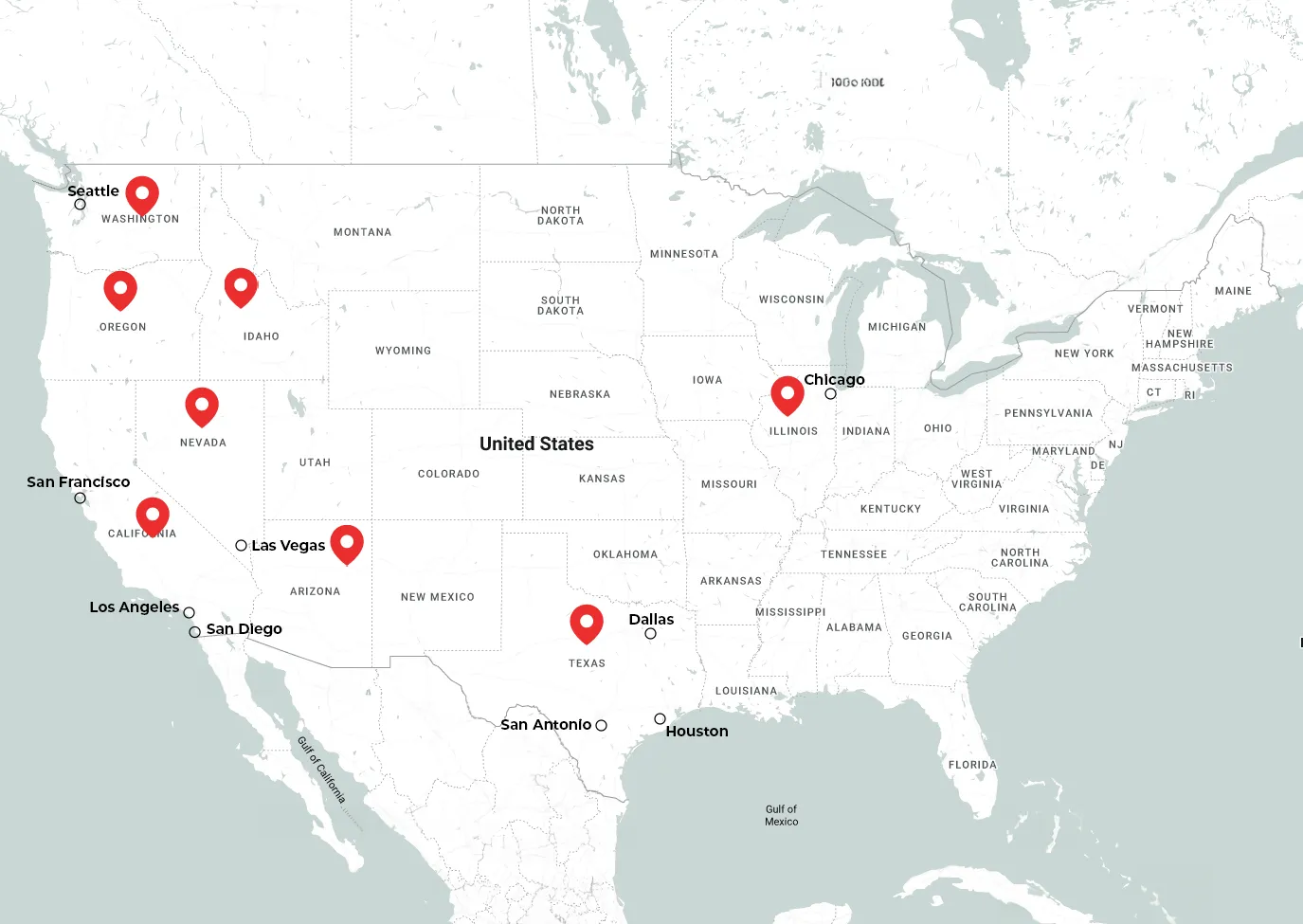

Contact us today for a review or quote on your errors and omissions insurance policy. Our experienced team will guide you through the process to ensure your business has the protection it needs. For more insights, visit our blog to learn why E&O and professional indemnity insurance are essential for business owners in California, Arizona, Nevada, Washington, Texas and Oregon..

Start a QuoteAreas We Serve

American Tri-Star provides auto coverage throughout California. Our car insurance agents in Orange County and San Diego County can help you understand your options. We also have representatives to assist your auto coverage needs in the Bay Area, Riverside County, and Los Angeles County.

Start a Quote